Glove Supply and the Supply-Demand Disequilibrium (Top Glove, Supermax, Hartalega, Kossan, Intco, and Others)

Author: Ben Tan | Publish date:

The top 3 concerns expressed regarding the near- and mid-term future of the rubber glove industries can be grouped as COVID-related, demand-related, and supply-related. I have previously discussed my findings and analysis in a summarized manner in the links below:

1. COVID-related:

- Timeline of the pandemic (as of beginning of January 2021)

- Additional problems with the timeline, and associated risks (as of end of January 2021)

2. Demand-related:

- Glove imports in the US (the main market)

- Glove imports in the UK, Canada, and Japan (3 of the top 4 second-tier markets)

- Post-pandemic demand drivers

3. Supply-related:

However, up to now I have not discussed in detail the worldwide supply side of the equation, as well as the supply-demand dynamics and the currently existing disequilibrium. I will attempt to do that in a concise manner below.

My Research

Over the last few weeks I have been working on a research related to the global supply of nitrile and latex gloves. I spent a substantial amount of time on the research in order to make sure that the data is as representative as possible. As with any real-life research though, albeit my best effort, available data is imperfect for a number of reasons, including the dynamically changing nature of the business, trade secrets, and different reporting standards in different jurisdictions, among a myriad of other reasons. Some general statistics related to my research:

- I managed to identify 123 manufacturers of nitrile and rubber gloves in the world.

- These include 86 Malaysian companies, 18 Chinese companies, a major Thai company, and a number of predominantly smaller players with manufacturing facilities in Thailand, Indonesia, Vietnam, India, Sri Lanka, USA, Taiwan, UAE, Algeria, Ukraine, and Turkey.

- Of these, I managed to unearth the production capacities of 72, including all of the major players.

- The highest percentage of available production capacity data is related with the listed companies, and in particular the newcomers in the glove manufacturing industry in Malaysia, of which I counted 19 companies, including 5 acquisitions of pre-existing players. Production capacity information is available for all of them.

- The second highest percentage of available data comes from companies members of the Malaysian Rubber Glove Manufacturers Association (Margma). I found information for all but 13 of these companies.

- I have strong suspicions that some of the other Malaysian companies, which are not members of Margma, have been acquired by some of the bigger players, or they have closed doors, as I did not find any up-to-date mentions of some of these companies.

- Overall, the data I have collected accounts for over 95% of the available production capacity of nitrile and latex gloves in Malaysia, according to data published by Margma last year, and I believe for over 90% of the available production capacity in the world.

Some additional notes on how the data might have been adjusted:

- The present capacity is estimated as at end-2020 for most companies. Where reports for extra capacity coming online have emerged, they have been taken into account in the present capacity figures.

- When the exact end date of additional capacity being commissioned is not known, the end of the earlier full year is used in most cases, unless discrepancies between different sources exist, in which case the end of the present full year at which the capacity is expected to be commissioned is used.

- The figures are self-reported by each of the companies, directly or indirectly. Thus, some of the figures may be inflated.

- At all times, the self-reported figures are taken to mean maximum production capacity at 100% utlization rate of the manufacturing facilities.

- The final figures are adjusted to 80% utilization rate. The industry average across the major players is 75%-80%, and it is lower for the smaller players.

- The full set of data is available upon request to anyone interested.

General Findings

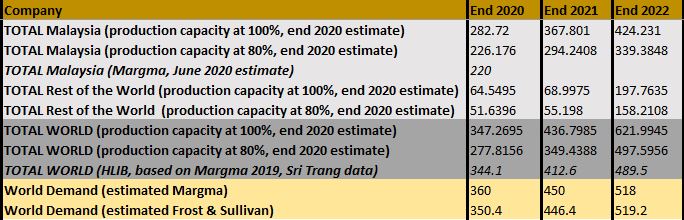

In my glove supply findings, I provide reference estimates from a 2020 Margma report (source), and from a Hong Leong Investment Bank (HLIB) report which is based on 2019 Margma estimates and data from Sri Trang (source, a downloadable file).

Demand data is based on 2021 Margma data cited by Top Glove (source), and on a 2020 Frost & Sullivan report (source).

My production capacity estimate for Malaysia at 80% utilization rate is above the 2020 Margma figure. My estimate for the world is below HLIB's estimate for 2020 and 2021, but above their estimate for 2022. This may be due to different adjustments or assumptions that might have been made in their analysis. For instance, the assumption for 2020 and 2021 might be at higher utilization rates than the normal utilization rates (closer to 100% for instance).

Additionally, I have included Margma's and Frost & Sullivan's natural growth estimates only. I have not included estimates on the excess demand for 2020 and 2021. According to Ansell (source, a downloadable file) and according to data by AmerCareRoyal cited by Forbes (source) the demand for gloves in 2020 was actually 585 billion gloves (from 350.4 and 360 billion projected by Margma and Frost & Sullivan).

As can be seen above, with all of these assumptions in mind, the projection is that by the end of 2022 there will be a shortage of between 20 billion and 30 billion nitrile and latex gloves.

Supply-Side Considerations

One of the most frequently expressed concerns on the supply side is that production overcapacity will lead to oversupply and a sudden sharp drop of average selling prices across the board. As can be seen from the illustration above, that is unlikely to happen. However, let's look more closely at where the main additional supply will come from.

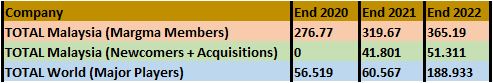

The main extra production will come from 3 groups of sources - Malaysian companies which are members of Margma, Malaysian newcomers and companies acquiring existing glove manufacturers, and major players in other countries. A major player is defined as a company whose production capacity at present is at least 5 billion pieces of nitrile and/or latex gloves. Where a company's main production facilities are in Malaysia, the company is listed as a "Malaysian" company for the purposes of this research.

As can be seen, most extra capacity will come from non-Malaysian players. Of these, by far the biggest contributor is the Chinese company Intco Medical. Intco plans to expand its production capacity to a total of 120 billion gloves over the next 15 months according to company's latest announcement (source). The current capacity of the company (as of last week) is 45 billion gloves. However, this capacity includes 24 billion vinyl gloves, and 21 billion nitrile gloves. For the purposes of this study we do not look at the vinyl glove market. In my assumption for the extra capacity, I have excluded the current capacity of vinyl gloves and I have assumed that all of the extra capacity will only go towards nitrile glove production. In other words the assumption is that by 2022 Intco will be able to produce 96 billion nitrile gloves per year. The second biggest non-Malaysian player - Sri Trang (Thailand), plans to increase its current production capacity of 32.619 billion pieces per year to 49.133 billion pieces per year by 2022 (source).

However, the second and third largest capacity expansions will be done by Malaysian companies. Top Glove reported 84 billion pieces production capacity (excluding vinyl gloves) and the company plans to increase that to 121.1 billion pieces by 2022 (source). Supermax plans to increase its production capacity from 26.175 billion pieces at present to 48.425 billion pieces by 2022 (source). As I have discussed before, this extra capacity excludes any capacity that will be commissioned overseas (see here).

There are so far 5 known acquisitions by non-industry players of Malaysian rubber glove companies:

- Diversified Gateway Solutions acquiring Duramitt (source)

- Salcon acquiring JR Engineering (source, source)

- Vizione Holdings acquiring SSN Medical (source, source)

- Inix Technologies acquiring L&S Gloves (source)

- Eonmetall Group acquiring Lienteh Technology (source)

Of course the acquired companies already have a certain amount of production capacity available. However, I have elected to give the figure for 2020 as 0 in this case in order to illustrate better this perceived additional capacity from newcomers to the industry. As can be seen, the maximum capacity from all 14 newcomers and 5 "acquirers" is estimated to be 51.311 billion pieces by 2022. This figure is significantly smaller than the figure for extra capacity coming from Intco alone, and it is slightly bigger than the extra capacity coming from Top Glove alone. Additionally, the 15 newcomers are expected to face difficulties such as raw material constraints, labor force shortages, and construction and production line installation related problems (source)

In total, out of the total projected extra capacity of 274.7 billion pieces per annum, 132.4 billion (48%) will come from major players outside of Malaysia, 88.42 billion (32%) will come from established players in Malaysia, and 51.3 billion (18.5%) will come from newcomers to the industry in Malaysia. In terms of individual players, 79.5 billion extra pieces per annum (or 29% of the entire extra capacity) will come from Intco, and 37.1 billion pieces (or 13.5% of the entire extra capacity) will come from Top Glove.

Conclusion

As a growth industry for over a decade now, the glove manufacturing industry is demand-driven. Any self-reported plans on additional production capacity will inevitably take the corresponding demand into account. Thus, it is possible that players with aggressive expansion plans but at the same time with major exposure to certain individual markets (Intco, exporting 50+% of its production to the US for instance) may change their strategy if the situation requires it. Overall, supply will be running behind demand at least in the next 2 years (according to Hartalega - for the next 3 years; source) even with the aggressive expansion of Intco, Top Glove, other major players, and the inevitable newcomers.

没有评论:

发表评论