Author: Sipekhuat | Publish date:

DeepFck!n Value BursaBets Here in KLSE : BIMB-WA

Most people have the “grass is greener on the otherside” mindset. However, without looking any further, we have our Own DeepFck!nValue counter in Malaysia too- BIMB-wa.

Introduction for BIMB and BIMB-wa:

News Analysis:

On 11 December 2019, announcement made by BIMB to undertake restructuring exercise to unlock value, transfer listing to Bank Islam. One of the condition caught our attention.

“Other aspects of the restructuring include a Scheme of Arrangement (SOA) by BIMB to settle its outstanding warrants, whereby BIMB warrant holders would be paid a cash consideration for the cancellation of exercise rights in respect of the warrants.”

https://www.theedgemarkets.com/article/bimb-undertake-restructuring-exercise-unlock-value-transfer-listing-status-bank-islam

BIMB-wa was issued to the renounceable rights of 426,715,958 shares of RM1 each in BIMB Holding Berhad. Now, We dont have to look at the Exercise price for all these warrants, because at the end of the day, BIMB will settle all the warrants with cash.

And recently 29/1/2021, BIMB announced a new condition;

“ (ii) the Warrants Consideration, which was originally proposed to be RM0.26 per Warrant via the First Announcement, has been revised such that the Warrants Consideration shall now be determined based on the five (5)-day VWAP of the Warrants immediately preceding the price-fixing date for the Warrants Consideration but shall in no event be lower than RM0.26 per Warrant.” https://malaysiastock.biz/Company-Announcement.aspx?id=1291884

Meaning to say that, regardless of what the price of warrants are, BIMB will buy back from market, using its 5 days VWAP before the price fixing date, and it will not be lower than RM0.26.

Well, isnt this a JACKPOT ? As you can see that your downside is already fixed, RM0.26, while the upside (depending on the price fixing date) will be unlimited ?

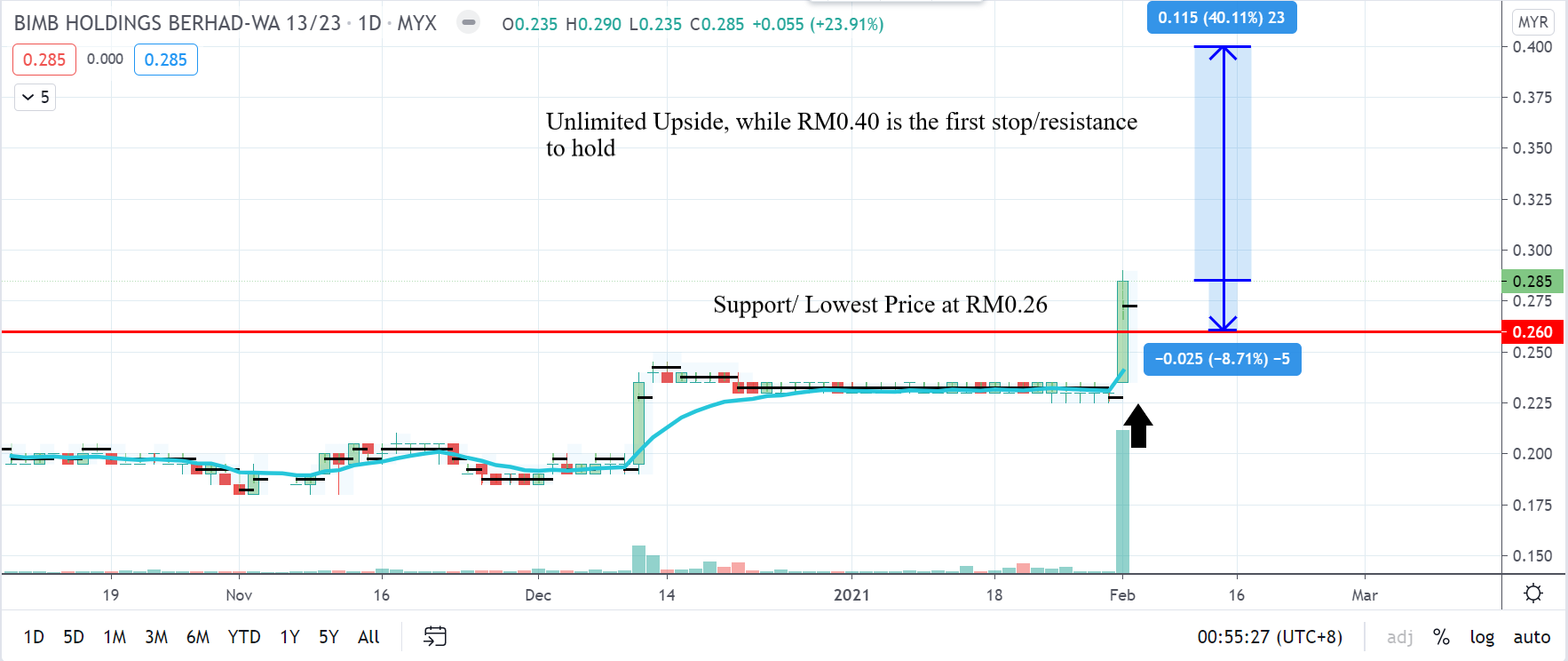

Technical analysis:

As you can see after the announcement made by BIMB on 29 Jan 2021, many smart investors rushed in to buy BIMB-WA. Any price below RM0.26 is a sure win. Price of RM0.26 is sure wont lose. However anything above, you already can see your downside is RM0.26, but, the upside is unlimited until they decided on the price fixing date.

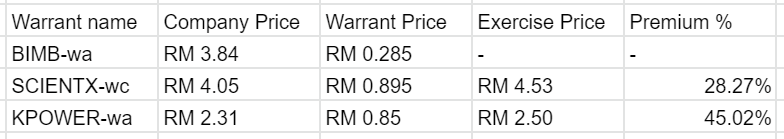

Also, lets compare other company warrants;

As seen above, BIMB-WA is comparable to those fundamentally strong stocks such as SCIENTX-wc and KPOWER-wa which warrants are at least RM0.85 and RM0.895.

Conclusion:

We believe in risk management when it comes to trading. When we know what is our definite downside, we already know the risk we are taking when taking a trade. The Reward to Risk ratio for BIMB-WA is 5.1 if the price goes to RM0.40 and sustain.

Previously, BIMB buy back the BIMB-WA for a maximum of RM0.260, however with this recent announcement, the buy back of the BIMB-WA is for MINIMUM of RM0.260. This tells us that BIMB are willing to pay to buy back the BIMB-WA for their restructuring plan to take place.

What will you do ?

DISCLAIMER: This post serves as an educational analysis and is never meant to be a buy/sell call or recomendation. Investors must always do their own due deligence before making any investment decisions. The author of this post is not liable in any way for any decisions made by any individual.

没有评论:

发表评论