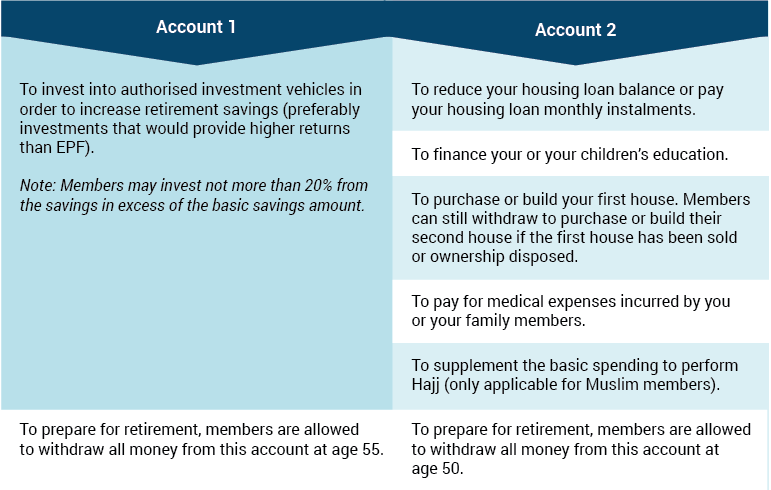

EPF Withdrawals

Details on Malaysia’s EPF (KWSP) Account 1 VS Account 2 withdrawals. The 15 different categories of withdrawals have been divided into Account 1 only, Account 2 only & both accounts withdrawals. Information is for general reference only & is an unofficial summary based on EPF’s official website. Additional forms, documents required & details may not be listed.

Updated: Dec 17, 2018

EPF Account 1 Members’ Savings Investment Withdrawal (EPF-MIS)

- Effective 2017 Jan 1 with higher minimum Basic Savings amount (Previous minimum Basic Savings)

- EPF approved investment funds only

- Min 3 months from last investment date

- On funds sold, amount returns to your EPF Account 1

- Min 1000 per investment

- Max 30% of amount in excess of Basic Savings (Min balance)

[Formula: Account 1 Ttl – Basic Savings * 20%]

E.g. Age 30 | Account 1 Ttl: 60kMax invest: 60k – 29k * 30% = 9.3k

Withdrawal to Purchase / Build a House

- Individual /Joint (immediate family OR no relationship) / Help Spouse

- Age < 55

- Buy / Build Residential (Note: Shop lot with residential unit qualifies)

- Financed through housing loan (EPF approved institution) / Cash purchase

- Not for renovation / 3rd house / overseas property / land

- Min 500

- Withdrawal for Housing loan: max 110% of house price less downpayment

- E.g. House price: 500k | Housing loan: 90% (450k)

Max withdrawal: 500k – 450 k * 110% = 55k

- E.g. House price: 500k | Housing loan: 90% (450k)

- Withdrawal for 100% housing loan (Zero downpayment): max 100% of house price

- Withdrawal for cash purchase: max 110% of house price

- Max total Account 2 balance

Withdrawal to Reduce / Redeem Housing Loan

- Individual /Joint (immediate family OR no relationship) / Help Spouse

- Age < 55

- Buy / Build Residential (Note: Shop lot with residential unit qualifies)

- Outstanding loan balance from approved Financial Institution

- Not for renovation / 3rd house / overseas property

- Withdrawal for 2nd house allowed only when first house is sold or disposed

- Only 1 application per year (from the previous housing loan withdrawal date)

- Total housing loan balance / Total Ac 2 / Min 500

Housing Loan Monthly Installment Withdrawal

- Age < 54 yrs & 6 mths

- Must be Buyer (or Builder) AND Borrower

- Pay actual monthly installment

- Max withdrawal: Total housing loan / Total Ac 2 / Cannot exceed monthly installment payment

- Min: 100 x 6mths

- Allowed to withdraw simultaneously for reduce housing loan balance AND loan monthly installment

- Payment for Refinancing

- Based on original loan balance OR latest loan balance (whichever is lower)

- Not eligible if the original loan balance is fully settled

Flexible Housing Withdrawal

- Process to set aside part of Account 2 savings to Flexible Housing Withdrawal Account to obtain a higher housing loan (aka Ring Fencing)

- Monthly contribution to EPF considered as income

- Savings in Flexible Housing Withdrawal Account CANNOT be used for housing, education, health & age 50 withdrawals

- Released only at age 55 / Full withdrawal (i.e. Leaving Country Withdrawal) / Death Withdrawal

- EPF Annual Dividends will still be given & credited into Ac 2

- Buy / Build Residential (Note: Shop lot with residential unit qualifies)

- Not for renovation / overseas property / land

- Age < 54

- Min savings period of 1 year

- Only for 1 house at a time

- Max application < Housing loan amount

- Transfer: One time (optional) + monthly

Education/PTPTN Withdrawal

- Self / Parent of Child

- PTPTN, Diploma, Advanced Diploma, Bachelors Degree, Masters Degree, Doctor of Philosophy or

equivalent - Local Institutions of Higher Learning:

- Academic (Full time, part time or distance learning)

- Professional Courses

- Vocational Courses

- Foreign Institutions:

- Full time

- Distance learning

- Tuition Fees / Lodging Fees / Study Loan

- Every Semester / Every Year

- Can withdraw multiple times as long as Ac 2 balance remaining

- Can file joint application with spouse for child

- Interview with EPF Officer required

Health Withdrawal

- For medical expenses and/or medical equipment for family members upon critical illness

- Family members: spouse, children, parents (including parents-in-law & step-parents), siblings

- Can make joint withdrawal with family members

- Max withdrawal: Total Ac 2 OR actual medical cost (whichever lower & only on amount not covered by medical insurance)

- Withdrawal can be for EPF approved medical aid equipment (wheelchairs, oxygen therapy, hearing aid, etc)

Age 50 Years Withdrawal

- Age 50-55

- 1 time only

- Full / Partial (one time withdrawal allowed only)

Age 55 Years Withdrawal

- Age > 55

- Full / Partial (min 2k; every 30 days) / Monthly (min 250 p.m.)

- From 2018 Jan: Full / Partial (no minimum) / Monthly (min 100 p.m.)

- Age > 60

- Starting from Jan 1, 2017 any EPF contributions made from age 55-60 will be into EPF Akaun Emas

- Full / Partial withdrawal from Akaun Emas only allowable upon reaching age 60

Hajj Withdrawal

- Age < 55

- Received letter with status Selected from LTH (Lembaga Tabung Haji)

- Insufficient savings in LTH

- Max withdrawal: 3000

Account 1 & 2

Death Withdrawal

- Submitted by nominee

- If no nominee, submitted by administrator / next of kin

- Death certificate & Submitter’s NRIC required

- With Nomination: Full withdrawal

- Without Nomination:

- EPF Account 1 & 2 Total < 2500: Full withdrawal

- 2500 < EPF Total < 25000: 2500 (1st 2mths) & Remainder (after 2mths)

- EPF Total > 25000: 2500 (1st 2mths), 17500 (after 2mths) & Remainder to person who provides Letter of Administration/ Letter of Probate/ Distribution Order (Land Office)/ Faraid Certificate (Syariah Court)

- Compassion additional death benefit of RM2,500 may be given to next-of-kin provided application made within 6 months for Malaysian citizens below 55

Pensionable Employees Withdrawal And Optional Retirement Withdrawal (Public Service)

- Employed in Public Service & emplaced in pensionable establishment

- Optional Retirement from Public Service

- Full withdrawal employee share of contribution including dividends if still have savings in EPF after government share returned to Retirement Fund (Incorporated) (KWAP)

- No longer considered a worker as defined by EPF act

Leaving Country Withdrawal

- Letter of Renounciation of Citizenship (Form K / Form Y) & other documents

Withdrawal Of Savings Of More Than RM1 Million

- Age < 55

- EPF savings (Total Account 1 & 2) min 1.05 million

- Min withdrawal: 50k (from Account 2 & if insufficient from Account 1)

Incapacitation Withdrawal

- Confirmed incapacitated, physically or mentally

- Achieved the level of Maximum Medical Rehabilitation (MMI) to work by a doctor who has examined you AND by a medical doctor in a Medical Board appointed by EPF

- Application supported with medical report dated < 1 year from date application received

- No longer working at time of application

- Requirement to attend interview session

- Additional Incapacitation Benefit from EPF of 5000

- Full

FAQ

Q: How can I check/claim unclaimed monies in EPF?EPF has launched an online Unclaimed Contribution Information Search.

Q. Is there a limit to the number of EPF withdrawals? For example, if I overlap my withdrawals from Ac 2 to serving housing loan & education loan.

A: You can have multiple withdrawals ongoing. However, it is subject to individual withdrawal limits. For example, you can only withdraw to reduce your housing loan after 12mths from the last withdrawal date.

Note: You can only have 1 home loan withdrawal from Ac 2 at any time

A: You can have multiple withdrawals ongoing. However, it is subject to individual withdrawal limits. For example, you can only withdraw to reduce your housing loan after 12mths from the last withdrawal date.

Note: You can only have 1 home loan withdrawal from Ac 2 at any time

Q: If I bought a property previously financed with Ac 2 withdrawal & later sold it off, would I be able to withdraw from Ac 2 usual for a new property purchase?

A: Yes. When you sold off your property, the amount you originally withdrew from Ac 2 would be returned to Ac 2. You can now withdraw from Ac 2 to purchase your new property.

A: Yes. When you sold off your property, the amount you originally withdrew from Ac 2 would be returned to Ac 2. You can now withdraw from Ac 2 to purchase your new property.

Q: If a person really wanted to, could he/she deposit extra money into either EPF account?

A: Yes you can make extra EPF contributions but only to Ac 1 which can only be withdrawn after age 55. If your EPF & insurance monthly contribution total is < 500 a month, you may want to consider making an extra contribution. EPF min returns 2.5%. Subject to EPF investment performance. One may want to invest in a vehicle with higher returns/liquidity (FD, endowment, shares, UT, property)

A: Yes you can make extra EPF contributions but only to Ac 1 which can only be withdrawn after age 55. If your EPF & insurance monthly contribution total is < 500 a month, you may want to consider making an extra contribution. EPF min returns 2.5%. Subject to EPF investment performance. One may want to invest in a vehicle with higher returns/liquidity (FD, endowment, shares, UT, property)

Contributing More Than The Statutory Rate (From EPF website):

You or your employer, or both, may contribute at a rate exceeding the statutory rate through the following options:

You or your employer, or both, may contribute at a rate exceeding the statutory rate through the following options:

If only you opt to contribute at a rate exceeding the statutory rate, you may submit a notice of election to contribute at a rate exceeding the statutory rate using Form KWSP 17A (AHL).

If only your employer opts to contribute at a rate exceeding the statutory rate, your employer may submit a notice of election to contribute at a rate exceeding the statutory rate using Form KWSP 17 (MAJ).

If both you and your employer opt to contribute at a rate exceeding the statutory rate, you and your employer may submit a notice of election to contribute at a rate exceeding the statutory rate using Form KWSP 17A (AHL) and Form KWSP 17 (MAJ) respectively.

This rate will be the new statutory rate and shall remain so until you and/or your employer submit a notice of cancellation using Form KWSP 18A (AHL) and Form KWSP 18 (MAJ) respectively. Upon receipt of the notification, the rate of contribution will be reverted to the current statutory rate.

If only your employer opts to contribute at a rate exceeding the statutory rate, your employer may submit a notice of election to contribute at a rate exceeding the statutory rate using Form KWSP 17 (MAJ).

If both you and your employer opt to contribute at a rate exceeding the statutory rate, you and your employer may submit a notice of election to contribute at a rate exceeding the statutory rate using Form KWSP 17A (AHL) and Form KWSP 17 (MAJ) respectively.

This rate will be the new statutory rate and shall remain so until you and/or your employer submit a notice of cancellation using Form KWSP 18A (AHL) and Form KWSP 18 (MAJ) respectively. Upon receipt of the notification, the rate of contribution will be reverted to the current statutory rate.

Q: Can I withdraw from Ac 2 to purchase overseas house, marriage or a personal loan?

Unfortunately the withdrawal is not allowed to buy a house abroad, marriage, personal loan or other purpose not stated explicitly by EPF.

Unfortunately the withdrawal is not allowed to buy a house abroad, marriage, personal loan or other purpose not stated explicitly by EPF.

Q: Can I withdraw for my children’s university studies?

Yes for diploma or equivalent & higher studies in academic / professional / skill-based / vocational course in an authorised institution of higher learning. Including tuition fees & airfare. You will need to submit offer letter & other relevant documents.

More info: kwsp.gov.my

Yes for diploma or equivalent & higher studies in academic / professional / skill-based / vocational course in an authorised institution of higher learning. Including tuition fees & airfare. You will need to submit offer letter & other relevant documents.

More info: kwsp.gov.my

Q: Is it true that EPF does not pay dividends if you keep your money in EPF above age 75?

There was a 2008 EPF policy that was never enforced. It has since been amended in 2015 (EPF Enhancement Initiative 3) & dividends kept voluntarily in EPF are given until age 100. Subsequent to age 100, the money will be transferred to Registrar of Unclaimed Monies.

There was a 2008 EPF policy that was never enforced. It has since been amended in 2015 (EPF Enhancement Initiative 3) & dividends kept voluntarily in EPF are given until age 100. Subsequent to age 100, the money will be transferred to Registrar of Unclaimed Monies.

Q: For those who have passed the age of 55, can the Akaun 55 be used to withdraw for investments in EPF approved unit trusts?

EPF’s MIS UT withdrawal is eligible until age 55 only. After age 55, Akaun 55 balances can be withdrawn. New EPF contributions in Akaun Emas can only be withdrawn upon reaching age 60.

Now I wish to withdraw for my property which was purchased at February 2014.

Can I?

Kindly let me know the list of documents need for PF withdrawal for purchasing a house.

My EPF account no.2 balance amount is approx. RM650K. Remaining amount will be paid by Cash.

KL6633

that with the new acct Emas, there will be no withdrawal of EPF money till 60 years old.Kindly clarify.

Thank you.

◘ Thus one who is self-employed (where no more monthly EPF contributions is made) falls into this category?

Thanks

Skin

1. You have chosen optional retirement from the Public Service and no longer employed OR

2. You have chosen optional retirement from the Public Service and reemployed with a different employer or self-employed OR

3. You have served in a government agency and have opted for retirement under a privatisation or corporatisation exercise but continue to work with the same agency

4. Below age 55

Borang Pindahmilik KTN 14A atas nama ahli yang telah disempurnakan oleh Pejabat Tanah ATAU sekurang-kurangnya Borang Pindahmilik KTN14A telah lengkap ditandatangani berserta resit penyata perserahan oleh Pejabat Tanah”

so they expect u buy a house that under your own name?

and in order to submit the change of name u need to paid the seller 100%. then why u need EPF then?

Tom

I purchased a property in 2013 and took a 90% loan but the loan has not yet been fully disbursed therefore, i’m currently still paying interest. Will I be able to withdraw from EPF Acc 2 to serve the interest and thereafter the full installment once it’s fully disbursed?

My ac2, now with approximate 70k, can withdraw full?

(i) A Malaysian Citizen; OR

(ii) A Malaysian Citizen who has made Leaving The Country Withdrawal before 1 August 1995 and later opted to re-contribute to the EPF; OR

(iii) A Non-Malaysian Citizen who:

Has become an EPF member before 1 August 1998; OR

Has obtained a Permanent Resident status (PR).

Have not reached the age of 55 on the date the application is received by EPF; AND

Still have savings in Account 2.

I want to know can I withdraw money from Account and invest in FD??

If a person who is ,unemployed at age of 50, and struggle to pay for housing loan. can withdrawal money from his 2nd account to pay the money?

I want to know can I withdraw money from Account 2 and started business?

Thanks for the insight!

As I read that “Not for 3rd house” in this article, below my case:

I had made a withdrawal from Acct 2 in Aug 2015 to July 2016 for “Housing Loan Monthly Installment Withdrawal”, where EPF deposited the payment to my personal account.

Now that I made a purchase on 2nd house, can I withdraw to pay my down payment? FYI, first house still yet to be disposed (not intend to).

If i pump in money in January 2018 into KWSP, would i enjoy the dividend declare on February 2018?